- I was lucky enough to travel to New York City to spend last weekend with my family.

- New York is still a fantastic city, but it has some very difficult times in commercial real estate on the horizon.

- With high vacancy and rising interest rates, office owners may need to come up with alternative solutions.

Last weekend was very fun for me. I was lucky enough to meet my family for a quick weekend getaway in New York City. And we got to celebrate my nephew’s 21st birthday. It was quite enjoyable. And while I mostly concentrated on spending time with the family, as we were walking around, I could not help but notice some things.

New York is a fantastic city – one of my favorites. But it has some challenges. And that includes in the commercial real estate world. So that’s what we are going to talk about this week – the greatness of New York and some challenges it is facing.

New York is Still as Great as I Remember

When I was a young lad – a younger lawyer – I lived in Manhattan. I was working for Vinson & Elkins at its New York office and having a fantastic time. But after a couple of years there, I was ready to leave. Not that I did not still love the City – I did. But it was just time. And I hate cold weather. So I moved back to Texas.

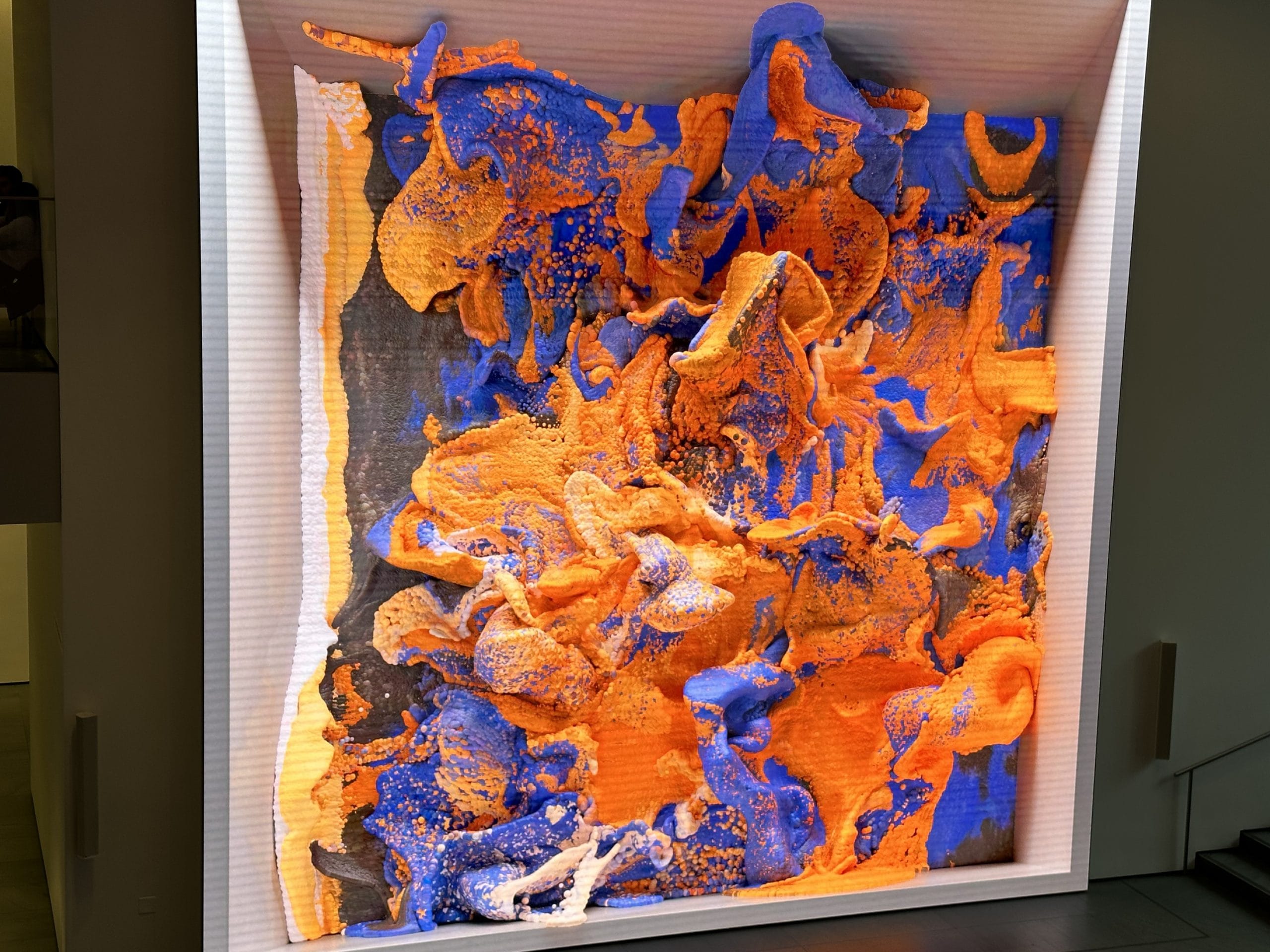

Sadly, I have only been back a few times since I left in 2006. And I often miss it. So this weekend we were able to take it all in – walked all over the City, saw a show on Broadway, ate at an Italian restaurant, went to a jazz club, and visited MoMA. It was a great weekend.

And while I mostly concentrated on having a good time with the family, I couldn’t help but look around at all those buildings and wonder what was going on inside.

New York’s Coming Real Estate Issues

As everyone knows, New York has a lot of big, giant office towers. I worked in one at the corner of 52nd and 5th. So as we walked around Manhattan, I kept looking up and wondering what their vacancy rates are. I mean – I know what its like in Texas. I’ve written about it here. It has to be at least that bad with all of this office space, right?

Well, unsurprisingly, it turns out it is bad. Depending on who you read, as of the first quarter this year, vacancy rates were between 17% and 22%. That means there is more than 94 million square feet of vacant space. That’s a record – at least for now. Most people expect those vacancy rates to rise. Indeed, city officials expect vacancy rates to stay above 20% through at least the end of 2026.

We all know why this is happening – its been discussed everywhere, including in this blog. With COVID, a lot more people figured out that they could work remotely. And, as a result, companies are downsizing their office space.

But, of course, that’s not the only issue facing commercial real estates. Interest rates have also climbed significantly. And New York has $137 billion in commercial debt that expires in 2023. And almost $500 billion in the four years after that. With these skyrocketing interest rates, it is going to be very difficult for commercial owners and developers to sell or refinance. So what will everyone do?

One possibility that keeps being discussed is to convert some office space into residential. But its my understanding that is very difficult to do and extremely costly. And in New York, it would likely require a lot of rezoning. But that just may be one of the possibilities that commercial real estate owners are forced to explore. Because for at least the next few years, owning office space in New York is going to be extremely challenging.