- As we all know, the office market is struggling and will likely to continue to struggle in the near future.

- There are likely to be more office buildings that have mechanics liens put on them by contractors who are not getting paid.

- This could present an opportunity for a savvy investor to capitalize on a distressed asset.

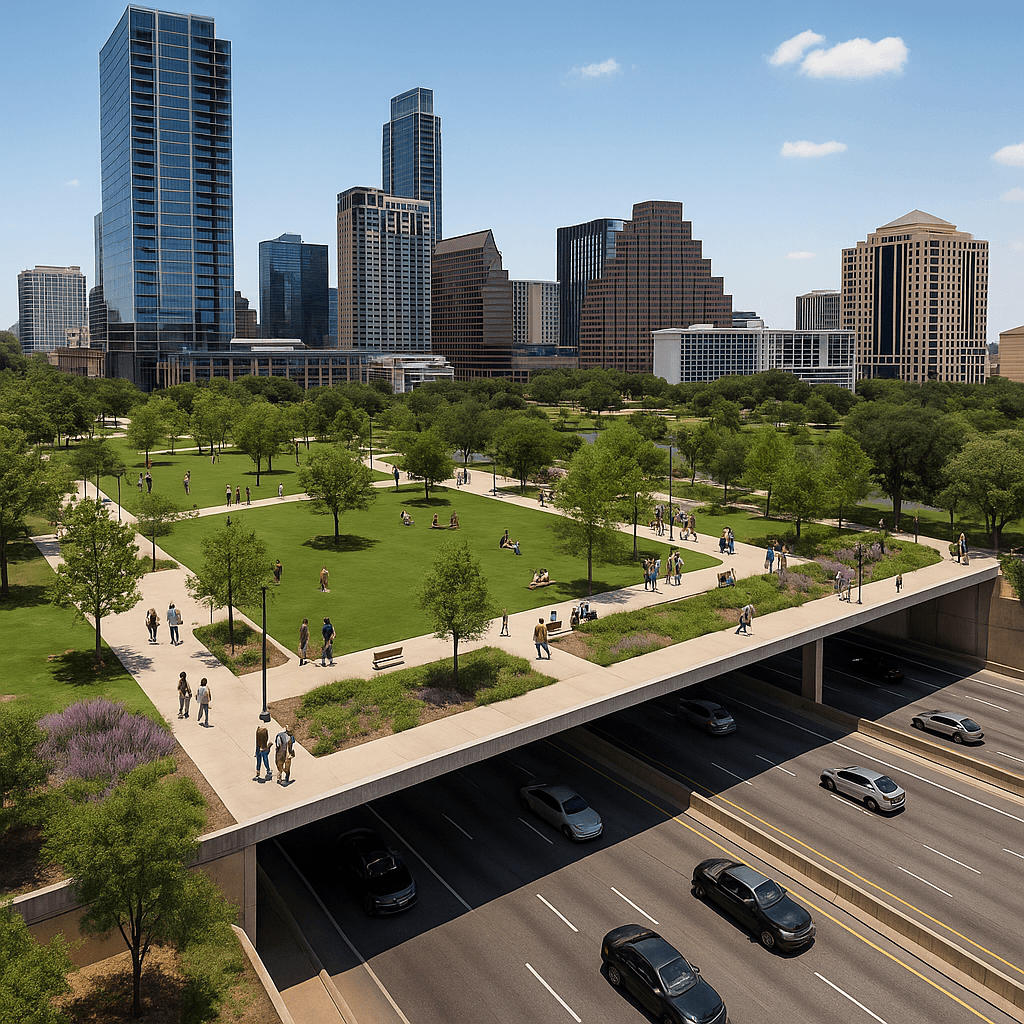

Texas has always been a land of great opportunity, and commercial real estate has been a cornerstone of that growth – especially in the last 25 years. But lately, the office sector has hit a rough patch. We have talked about that a lot in this blog. And, of course, everyone in the industry is having those discussions around town.

The pandemic’s remote work revolution has left many buildings partially vacant, with vacancy rates in some major metros eclipsing 20%. This certainly leads to a buyer’s market, with landlords struggling to fill space and lenders getting nervous.

And its left a lot of office owners struggling to pay some vendors. Indeed, the tallest tower in Fort Worth has mechanics liens totaling $1.6 million recorded against it. So what does that mean for the industry? And does it present an opportunity for savvy investors? That’s what we talk about this week.

Mechanics Liens: A Contractor’s Weapon

Imagine a scenario: a developer bites off more than he or she can chew, hires a contractor to build a fancy new office complex, then can’t pay the bill. In Texas, that contractor has a powerful tool at their disposal – the mechanics lien.

A mechanics lien is a legal claim against a property that secures payment for labor or materials furnished for its improvement. It essentially says, “If you don’t pay me, I get a stake in your building.” This can be a real headache for a property owner, as it clouds the title and makes refinancing or selling the building difficult.

Notice Requirements for Mechanics Liens

Here in Texas, things get a little more complex. Unlike some states, filing a mechanics lien isn’t a slam dunk. Contractors (and subcontractors and suppliers) have to comply with strict notice requirements depending on their role in the project. Original contractors (those with a direct contract with the owner) generally don’t need prior notice. But everyone else – subcontractors, material suppliers – needs to send out pre-lien notices to preserve their lien rights.

It’s a bit of a bureaucratic dance, but get it right, and a mechanics lien can be a powerful tool to force payment.

Foreclosure and Judgment: Taking it to Court

Once a contractor places a mechanics lien on a property, the contractor can sue to foreclose on the lien. This means going to court and asking the judge to order the sale of the property to satisfy the debt. It’s a lengthy process, but if successful, the contractor gets paid from the proceeds of the sale. It is also, of course, a very powerful bargaining tool to use against the property owner.

This is where things get interesting for outside investors who could see this as an opportunity. Let’s say the office building is half-empty, struggling financially, and gets slapped with a hefty mechanics lien. The owner might be desperate to avoid foreclosure. This creates a prime opportunity for an investor to swoop in.

Distressed Deals and Deep Discounts

There are two main ways an investor can potentially capitalize on this situation:

- Buying the Lien: Investors can buy the mechanics lien itself from the contractor at a discount. This essentially means they step into the contractor’s shoes and pursue foreclosure themselves. This can be a risky proposition, as the foreclosure process can be expensive and time-consuming. But if successful, the investor could end up owning the entire office building for a fraction of its original value.

- Buying the Foreclosed Property: If the foreclosure goes through, the investor can bid on the property at auction. With a distressed market and a cloud hanging over the title, there’s a good chance of getting a deep discount. Now, the investor owns a potentially valuable asset at a fire-sale price.

Proceed with Caution

There are, of course, potential pitfalls with either of these two strategies that an investor should be leery of –

- Legal Expertise is Key: This is complex legal territory. Don’t go it alone. Hire a lawyer experienced in Texas mechanics liens to navigate the process and ensure everything is done by the book.

- Due Diligence is Mandatory: Do your research on the property, the lien itself, and the overall market conditions. Is the building structurally sound? Are there other liens? Is there potential for future vacancy?

- Be Patient: Mechanics lien enforcement and foreclosure can take months, even years. Don’t expect a quick payday.

The Bottom Line: A High-Risk, High-Reward Proposition

The Texas commercial office market is in flux, and that creates opportunities for savvy investors. Mechanics liens can be a powerful tool for contractors to secure payment, but they also present a potential windfall for those willing to take a calculated risk. Do your homework, get good legal advice, and you may have a great investment opportunity.