- The TC Energy Center – an office tower – in Houston is in default of its debt.

- With vacancy rates and interest rates both up, the Texas office market is facing some very difficult times.

- Owners and developers will have to get creative to seize upon the opportunity that this downturn may present.

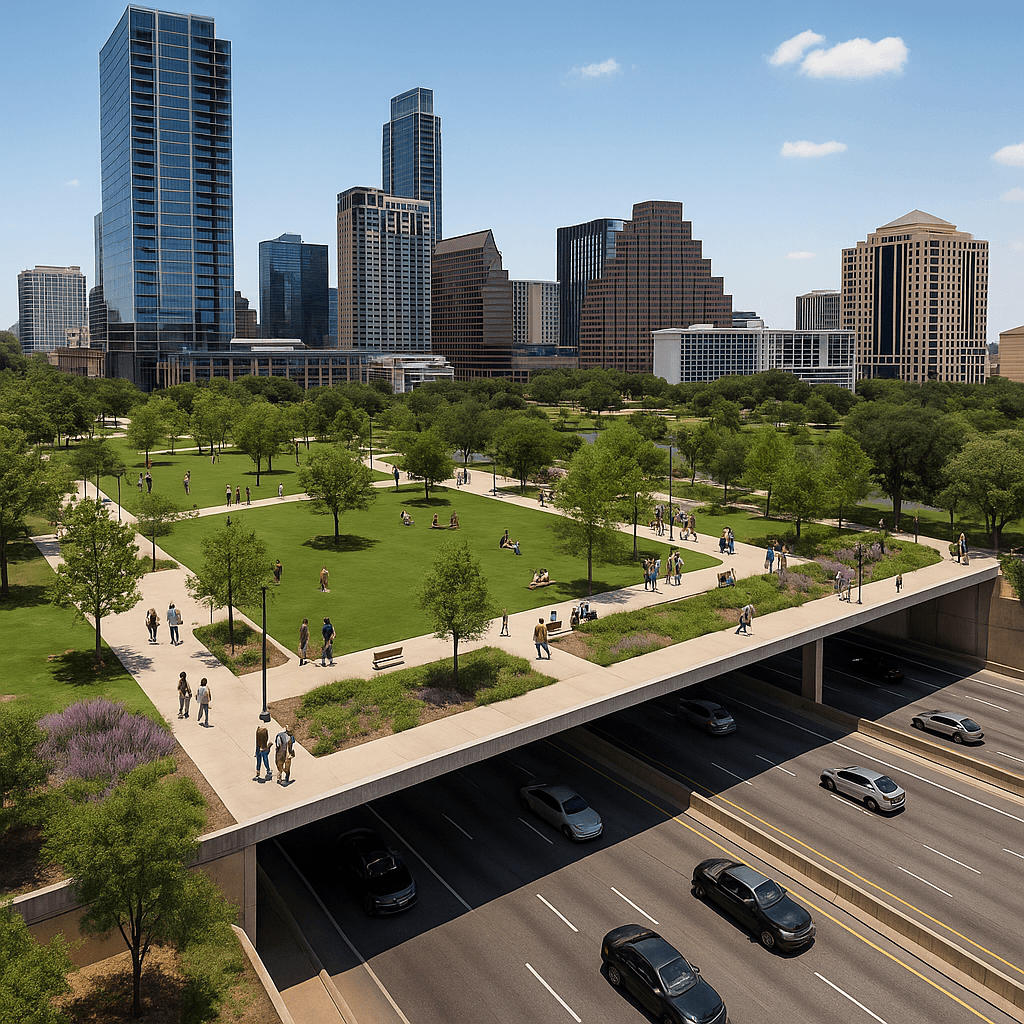

I live in Austin. And whenever I drive downtown, I am always amazed by the number of cranes with new high rises going up. Or when I look at pictures of the Austin skyline from 2010 compared to today and see the remarkable growth. But those tall buildings can be misleading. Here in Austin, for example, we know we have some empty skyscrapers downtown. And the TC Energy Center in Houston is, sadly, a prime example of the falling occupancy rates plaguing the Texas office market. It’s a problem for a lot of property owners throughout our state. And country. So what can an owner do? Lets talk about it.

Current Office Market Overview

We have talked a few times in this blog about the state of the office market in Texas. But what does it actually look like out there? Well in the fourth quarter of 2023, DFW office vacancies hit approximately 21%. This is, obviously, significantly higher than the pre-COVID levels. In Houston, vacancy rates are somewhere between 23-25%. Austin, unfortunately, was in the same general area. And San Antonio was closer to Dallas – just under 21%. Again, all of these are significantly higher than they were prior to COVID.

So, what happened? Did everyone suddenly discover the joys (and difficulties) of working from home? Did Zoom meetings replace the watercooler gossip as the office’s new social lubricant? Well it’s a combination of things. The pandemic gave both employers and employees a taste of the remote life, and some folks don’t want to go back. And companies figured out they can get production and work completed without having to pay for as much office space. But we are seeing some push back. Many companies have shifted to requiring employees to come back to the office. That could potentially be good news for the office market.

The Future of the Market

With the low vacancy and high interest rates, what options does a struggling office owner have? How can an owner avoid becoming the TC Energy Center?

One option is recapitalization – finding new investors to buy out current ones and/or partially refinance the debt. This is, of course, not very easy right now in a world where debt and equity is extremely difficult to find.

Its also possible to try to refinance the deal. But again, debt markets are incredibly tight. And whatever debt is out there for office buildings are going to have large interest rates. And that may not be financially feasible for the owner.

Perhaps an option is to repurpose these buildings. I have talked to a lot of developers who tell me that trying to repurpose office into housing is difficult and expensive and not realistic. But what about repurposing into medical or a lab or a data center? Could the building be used for that? Its certainly something worth thinking about.

The bottom line is this: the Texas office market isn’t dead, but its not exactly thriving either. It is going to take a lot of creative minds to save these buildings. And sadly, some current owners are likely to lose money. But when any downturn or difficult time comes around, opportunity follows. So let’s see what is out there and come up with some creative ideas.