- Almost every commercial real estate purchase agreement requires an escrow deposit.

- Usually the contract has a provision that allows the buyer to terminate the agreement and receive a refund of the escrow deposit.

- But with a hot seller’s market, its important to understand that certain seller demands can eliminate a buyer’s refund provisions.

We have talked a little bit about the commercial purchase and sale agreements the last few weeks. And today we are going to revisit that. Overall, there are basically two reasons I have written about purchase agreements lately –

1) Texas has some promulgated forms that people often use. This lulls buyers into thinking that they do not need a lawyer to review a purchase agreement before signing it. And as I have written previously – I disagree.

2) But if you are going to just rely on the broker to help you sign up the purchase agreement, hopefully with reading some of these tips, you will be in a better position if something goes wrong.

I am continuing this week, writing about commercial purchase agreements. And this week, specifically, I discuss the escrow deposit sections of an agreement.

Escrow Deposit Basics

Many of you reading this probably already know the basics of how the escrow deposit works. But it is always good to have a solid baseline of understanding.

Every commercial purchase agreement will have a provision for an escrow deposit. This is the initial deposit that the buyer must put down to show it is serious about purchasing the property. It is generally refundable (or mostly refundable) if the buyer terminates the agreement during the due diligence period. The title company for the acquisition holds the escrow deposit. And the amount of deposit can vary depending on what the parties agree to.

New Developments with Escrow Deposits

The above outlines the basics of escrow deposits in commercial purchase agreements. With minor changes, escrow deposits have been like that for a long time and most people understand that is generally how it works. But we have seen things change a little lately here in Texas.

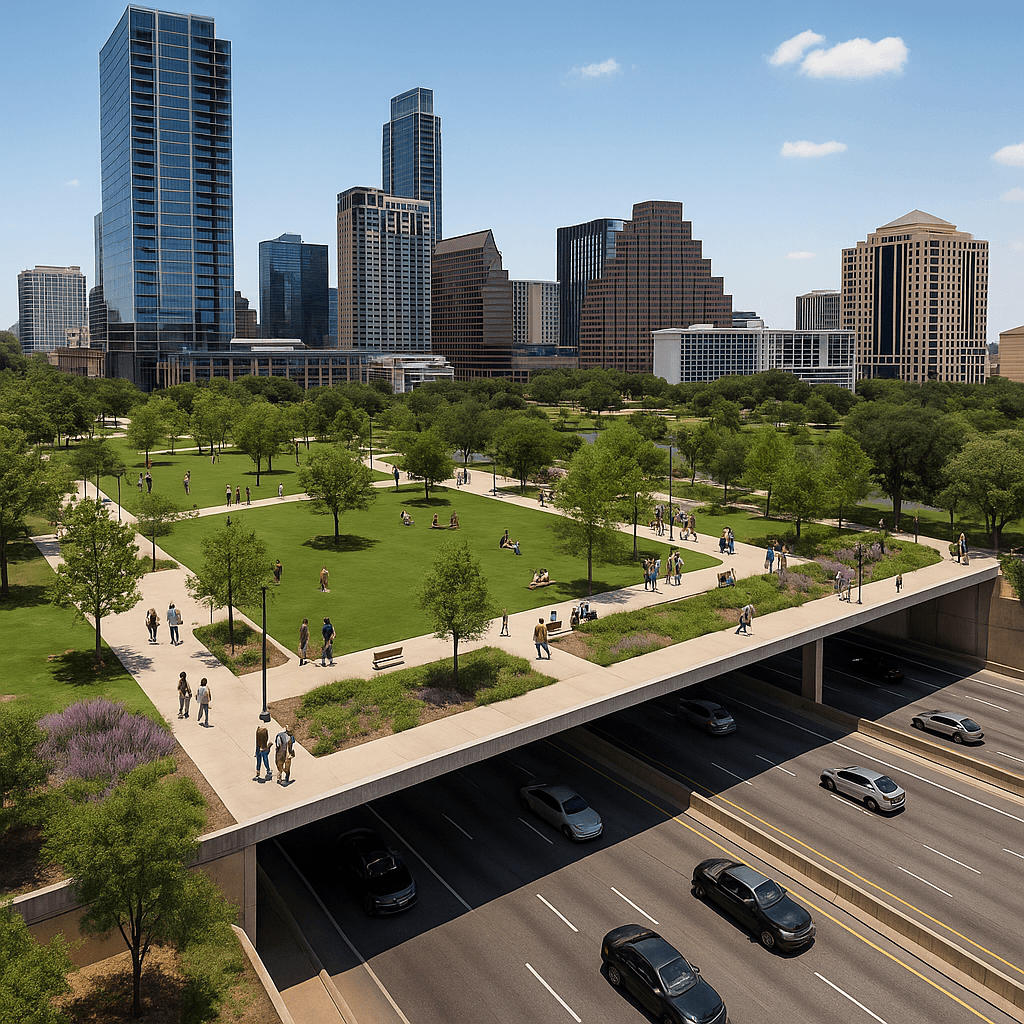

As anyone who reads this blog probably knows, the Texas commercial real estate market (or residential, for that matter) is on fire. There are few better places to invest than in Texas. As a result, sellers have been getting more aggressive in what they are requiring in purchase agreements. Some sellers, therefore, are asking for the escrow deposit to be non-refundable right at the start of the deal. The buyer, therefore, has no opportunity to conduct due diligence for free.

As a lawyer for buyers, this is a very frustrating development. I am generally very much against a buyer putting hard escrow money up-front before diligence. But ultimately it comes down to a business decision. I certainly understand if this is what needs to be done to get deals under contract. Just make sure you do as much due diligence as you can prior to signing the purchase agreement.

A Deal Breaker Provision

But of a buyer can usually terminate a purchase agreement with a full refund for an additional reason. If there are any issues with title to the property that the seller does not or cannot correct, generally the buyer can get a full escrow deposit refund.

Which brings me to another seller requirement that I have heard about but not yet seen personally. I have been told that some buyers are requiring sellers to forfeit their right to terminate with refund for title defects also. I do not think a buyer should do this unless it is completely comfortable walking away from its escrow deposit.

Waiving due diligence is one thing – you can generally correct any problems with the property by just spending more money. Obviously that’s not ideal – but it may not be fatal to the investment.

But you can’t fix title defects with money. Well, I guess you can, but its likely to be A LOT more expensive and time consuming than a normal due diligence issue. Please, therefore, do not agree to a provision that would waive a refund of the escrow deposit for title defects unless you are completely comfortable walking away from that escrowed amount.

Escrow deposits have been around in commercial purchase contracts for a long time. But as the market changes, the provisions sometimes change – as they have recently. As a result, it is always best practice to have a lawyer review your purchase agreement before you sign it.