- The Federal Government’s increased unemployment benefits have likely helped multifamily assets maintain through COVID.

- Those unemployment benefits are ending for many states – including Texas.

- While there are some rental assistance programs available, the immediate future for multifamily assets is precarious.

Its not news to say that COVID-19 has had a very significant negative effect on the United States’s – and Texas’s – economy. Many businesses have had to, at least temporarily, shut down. And even when they are open, people have been reluctant to leave their homes.

Commercial real estate has not been immune to this downturn. As people avoid restaurants and bars and retail shops and hotels – the tenants that rent space from commercial property owners are having great difficulty paying their rent. And, as a result, many property owners are having difficulty paying their mortgage.

Multifamily has Mostly Held Steady So Far

But despite the hit to the economy, thus far multifamily seems to have weathered the storm. There is no doubt that delinquencies have risen some and rental rates have decreased some – for the first time in a while in some areas. But this decline has so far been relatively contained and multifamily has mostly held steady.

The theory is that increased unemployment benefits have helped to reduce delinquencies at apartment communities. As you likely know, when COVID first hit, Congress passed the CARES Act that increased maximum weekly unemployment benefits to $600 per week. When Congress could not reach an agreement on an extension of the CARES Act, those increased unemployment benefits expired on July 31. Shortly thereafter, President Trump issued an executive order increasing unemployment benefits to a max of $300 per week. But now these unemployment benefits are coming to an end here in Texas. FEMA has decided to end the program – capping it at six weeks. As a result, many Texas tenants who are out of work will see their monthly income decrease significantly.

How will this affect Texas apartment communities? Will we see delinquencies increase significantly?

Since Mid-March, 3.4 million Texans have filed for unemployment relief. In July, the unemployment rate fell to 8% statewide. We can assume that the August unemployment rate was a little below that. While that is below the nationwide levels, it is still significantly above what it was in 2019. That high unemployment rate, combined with the lack of increased unemployment benefits, could mean multifamily property owners are facing precarious times ahead. We may start to see the effect of those changes starting in October.

Help for Renters is Available

Recognizing this potential crisis, some cities are providing help for renters. We could – and have – talked extensively about the misguided eviction moratoriums. But cities are also providing some help to renters:

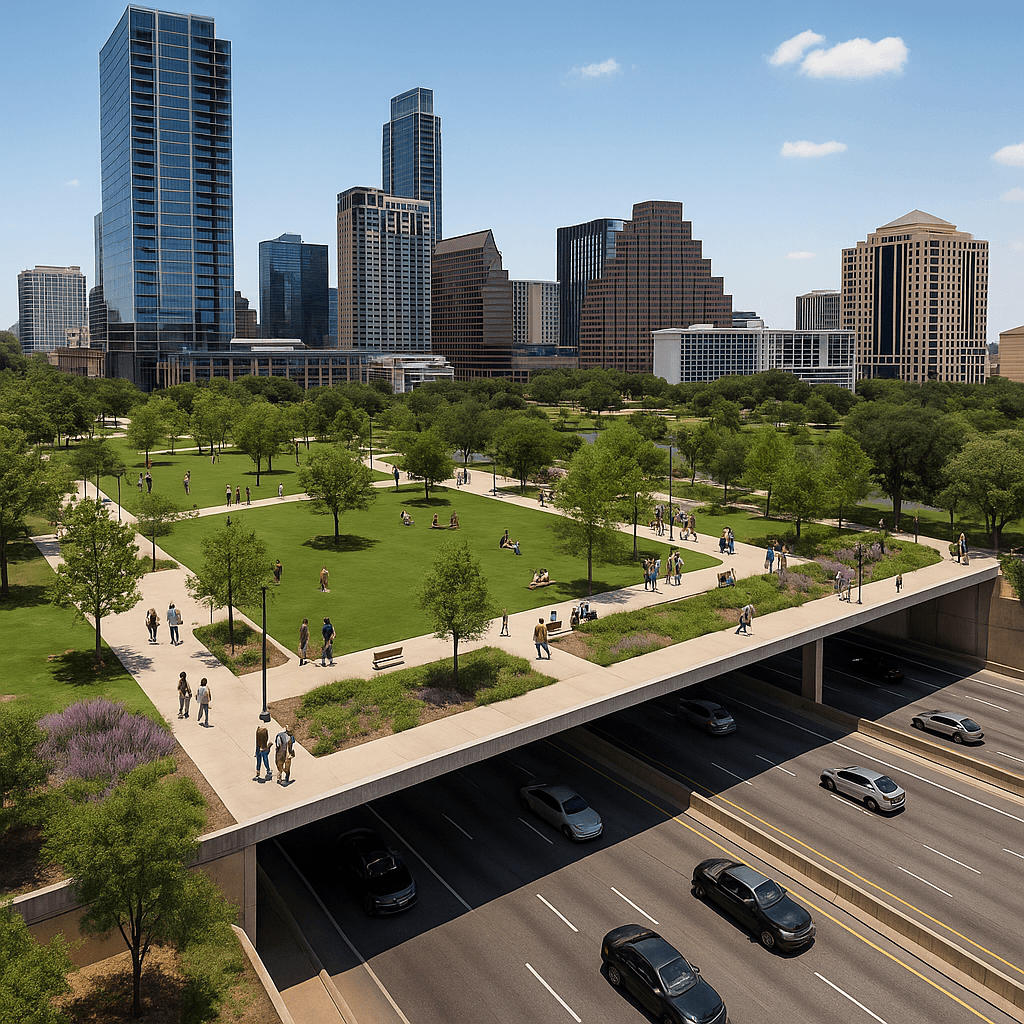

Austin RENT Program – Austin has made $13 million available to help tenants with rental payments;

In addition, many non-profits in these cities have their own rental assistance programs.

Unclear what Federal Government Will Do Next

With President Trump’s executive order increasing unemployment benefits expiring for many states, its unclear what the federal government will do next – if anything. Congress does not appear to be any closer to a new COVID-19 aid package. And the President has not – as of yet – indicated that he will extend his executive order.

I think, rather than increasing unemployment benefits, it would make more sense to provide housing vouchers of some kind for tenants that are out of work. This could take the form of direct payments to landlords to cover the tenant’s rent.

But there is no indication that this, or any, relief is coming soon. As a result, multifamily property owners may face a difficult immediate future.