The Return of the Company Town?

- Company towns were popular in the late 1800s and early 1900s. But because of problems associated with them, they fell out of favor.

- As a way to help with affordable housing, some Silicon Valley companies are planning to build housing for their employees.

- While this could be a great benefit, they likely want to avoid the mistakes of company towns in the past.

Two weeks ago, I wrote briefly about Tesla planning to build a subdivision in conjunction with a local developer that will largely be powered through Tesla solar panels. It was an interesting, exciting idea and I used it to talk about solar power and whether it makes sense for property owners.

But as I was reading the article, another thought popped into my head. And I want to come back to that thought this week. The neighborhood that Tesla is planning to build is near the new Tesla plant. It does not appear to be exclusively for Tesla employees but because it is so close to the plant, it reminded me of the old company towns that used to exist. And that reminded me that a couple of years ago, some of the big Silicon Valley companies were looking into building company towns as a way to provide affordable housing for their employees.

So that’s what we are going to talk about this week – the company town. Is it a way to provide affordable housing? Is it a good idea? Would Bukowski Law Firm employees want to live in one? Lets see.

The History of the Company Town

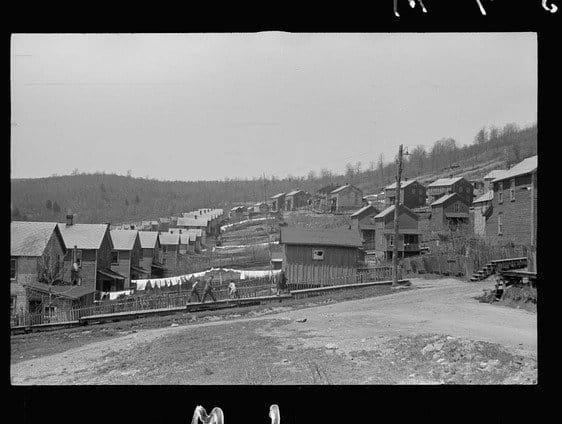

If you are not familiar with company towns, they were popular in the late 1800s and early 1900s. There were companies that had a lot of employees – sometimes out in the middle of nowhere, not near any other housing. And often these were very low paid employees. So, for example, Pullman, Illinois was built around the Pullman Palace Car Co. or Hershey, Pennsylvania had candy factories where they employed a lot of people.

As a way to solve their housing problems, the companies built towns where the employees could live. Generally all of the buildings and shops were owned by the company and employees could lease a house to live in. They had shops, schools, etc.

These fell out of favor, however, when they became problematic. With nowhere else to go, the employees were forced to rent from the company and shop at the stores. And sometimes the rent and shop prices became exorbitant. As a result, the employees could go into great debt to the company for whom they worked. So not only would an employee have to live in the town if they wanted to work at the company, they often would run up a debt to the company that would have to be paid off before they could leave. It created a sort of indentured servant status for many employees and, as a result, fell out of favor.

Recent Examples

A couple of years ago, Facebook, Google, and Amazon were facing terrible housing issues in Silicon Valley. Their employees were having a difficult time finding reasonably affordable housing to live in near the work campuses.

As a way to potentially solve this problem, each of the companies announced they were going to build some (relatively) affordable housing for their employees.

Facebook is still in the planning stages of building 1700 units near its Menlo Park, California headquarters. Google, meanwhile, through its parent company Alphabet, was planning to build 300 prefab houses for its employees. Those plans expanded in 2019 when it invested $1 billion to build 15,000 modular homes in the next 10 years. Amazon, meanwhile, has pledged $2 billion to build affordable housing in three different cities where it has a large number of employees.

We have talked a lot in this blog about the nationwide affordable housing crisis. So I think these companies should be applauded for trying to find creative solutions to the problem for their employees. These do not appear to be traditional company towns – they appear to just be the housing component.

And yet, its hard not to be a little leery of company sponsored/owned/built housing. The devil is always in the details, but will these be leases for employees? Or will they be owned? And if they leave Facebook/Google/Amazon, will they have to leave their homes? That is potentially a very big problem and could tie the employees to their jobs beyond when they would normally want to stay.

Obviously this is not a reason for these companies to stop building this housing. Its just we need to be aware of some of the problems that arose with company towns in the past and design these to avoid those issues.

And if anyone has a good site for the Bukowski Law Firm Company Condos, please let me know.