Austin Must Solve its Homeless Problem

- Austin has a terrible homelessness issue that is getting worse by the day. At least one local group is trying to get the City Council to address it.

- Rampant homelessness is not good for anyone – not the people on the streets nor the nearby property owners.

- But homelessness is not inevitable. It can be solved. Other cities have had success.

- We must demand more of our Austin leaders to solve this issue.\

On Friday, November 20, the leaders of a local group called Save Austin Now filed suit against the City of Austin for rejecting its petition on homelessness. Earlier this summer, Save Austin Now submitted a petition to the City trying to reinstate the ban on camping in public. Under Austin law, a citizen initiative requires the citizen to submit a petition to the City with at least 20,000 signatures. If done, the City Council must approve issue or put it to a vote. In its petition, the Plaintiffs state that, instead of doing that, the City Clerk rejected the petition for not having enough signatures.

That lawsuit is just starting but I think the more interesting point is who makes up the leaders of Save Austin Now. The two leaders are a longtime local Republican and a Democratic activist. This may not surprise you too much, however. Because the runaway homelessness in Austin is a bi-partisan issue.

How the Problem Started

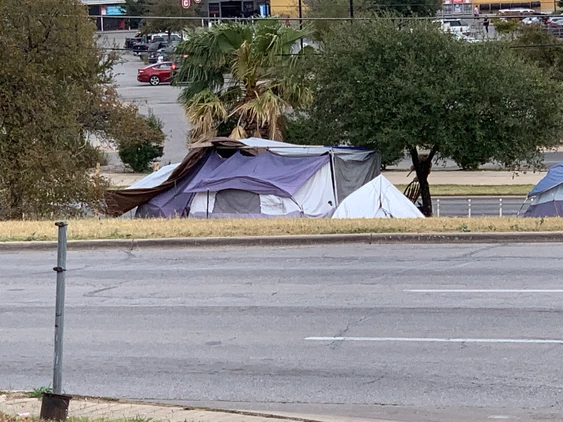

Austin – like any big city – has always had a homelessness problem. But it became exasperated when, in mid-2019, the Austin City Council repealed the local ordinance against camping on public grounds. As a result of this, people are free to set up camps on public grounds all around the City. We, therefore, get encampments under most overpasses, in the median along East Riverside, in public wooded areas, etc.

This has caused significant issues for Austin businesses. Allowing people to camp on public lands outside privately owned businesses discourages people from patronizing those businesses. Commercial real estate owners know this as well as anyone. East Riverside is a rapidly developing area in Austin. But permitting the encampments all along the median on Riverside has a chilling effect on all those new developments.

Austin Must Take Action

Since the summer of 2019, when the camping ban was rescinded, things have not gotten better – they just continue to get worse. While the City Council appears to make minor, unsustainable attempts at resolving the issue – like buying small motels to house a few people – the issue requires a more comprehensive plan.

I am not here to tell you what should be done. I am no expert in this area and do not know what the solution is. But there are experts out there. It can be done. We can help people significantly more than we are now.

For example –

San Antonio – The city has used a collaborative effort from traditional homeless providers, as well as the police, the business community, mental health officials, etc – to significantly decrease downtown homelessness.

San Diego – Through the City’s Community Action Plan on Homelessness – a comprehensive 10 year program – San Diego reduced homelessness by 12% in 2019.

Trieste – A city in northern Italy has radically reduced homelessness by focusing on mental health issues.

The point is, homelessness is not inevitable. It can be reduced. But to allow it to run rampant does not help anyone – not the people on the streets nor the nearby property owners.

And Austin’s city council has not done nearly enough to address these issues. We are not helping the people in need. And we are actively hurting businesses and property owners.

We need to demand more from our leaders – or vote them out.